|

March 5,

2010

School

Board provided inaccurate figures to The Goffstown News:

EMAIL EXCHANGE

$610,000

"missing" from public hearing budget

presentation falsely "lowers" tax rate

projections; Budget

Committee demands names of individuals responsible

By GUY CARON The following is the email exchange

between Mr. Cloutier and the school district (emphasis

added). Click

here to read the entire article.

Cloutier's

initial email:

-------- Original Message --------

Subject: Budget Comm - Request for Calculation

Date: Thu, 4 Mar 2010 8:52 PM EST

From: Daniel J. Cloutier <AlphaOmegaNH@comcast.net>

To: Ray Labore <rlabore@Goffstown.k12.nh.us>

CC: Keith Allard <kallard@Goffstown.k12.nh.us>,

(Goffstown Budget Committee)

Ray,

In a March 4, 2010, Vol 53 No 22, Goffstown News article that began in the top right hand corner of page one and concluded on page 12, you were quoted as indicating that the estimated tax rate of the school operating budget is $14.93 per $1,000 of assessed property value. The article then further states that the estimated tax rate of the default budget is $15.07 per $1,000 of assessed property value. I cannot calculate this tax rate given the information provided by the school district even if I use the numbers the school board came to at their Thursday, January 14, 2010 meeting.

Given there is an $803,254 difference between the warrant article and the default, with an approximate $.071 tax rate per $100,000 of appropriation, the tax rate difference between these is approximately $.57 per $1,000 assessed valuation (803,254 / 100,000 * .071).

The Goffstown News erroneously reports this difference as $.14 or $35 on a $250,000 assessment. That number is actually closer to $142.50 given the numbers the Budget Committee received from the school district.

On behalf of the Budget Committee & pursuant to

RSA

32:16,II, I ask the following:

Did the Goffstown News report that which was provided by you?

If yes:

How much of the information was provided by you?

Please share the information and methodology used to calculate this tax rate.

If no:

Can you shed any light on how the Goffstown News came up with these amounts?

Thanks,

Dan |

The

following morning, Allard, not Labore, responded as

follows:

-------- Original Message --------

Subject: Re: Budget Comm - Request for Calculation

Date: Fri, 05 Mar 2010 10:29 AM EST

From: Keith Allard <kallard@goffstown.k12.nh.us>

To: <AlphaOmegaNH@comcast.net>, Ray Labore <rlabore@goffstown.k12.nh.us>

CC: (Goffstown Budget Committee)

The numbers provided to and reported in the paper were the projected total tax effort for the school district; the sum of the estimated local and state tax rates.

The paper already had the Budget Committee’s $12.52 local rate and added the projected state rate of $2.41 to get to the total effort of $14.93. The rate ascribed to the default budget includes the effect of returning a $610,000 unreserved fund balance (the projected $310,000 and assumed the defeat of the $300,000 Bartlett Capital fund deposit). That arithmetic calculation resulted in a $12.66 local rate + $2.41 state rate = $15.07 total. |

Cloutier

immediately took issue with Allard's explanation.

-------- Original Message --------

Subject: Budget Comm - Request for Calculation

Date: Fri, 5 Mar 2010 11:09 AM EST

From: Daniel J. Cloutier <AlphaOmegaNH@comcast.net>

To: 'Keith Allard' <kallard@goffstown.k12.nh.us>

CC: Ray Labore <rlabore@goffstown.k12.nh.us>, Stacy Buckley <sbuckley@goffstown.k12.nh.us>,

(Goffstown School Board), (Goffstown Budget

Committee)

Keith,

Thank you for this response. It is

inaccurate.

The Budget Committee’s projected local tax rate given numbers supplied by the school district including an estimated return of $610,000 is $12.22. The estimated impact for the state education is $2.31 for a projected total tax effort for the school district of $14.53. This is the net estimated cash basis tax rate for the operating budget with the defeat of article 4. (If the paper ever printed $12.52, that amount was in error as well.)

From your response, it appears that someone inaccurately took the difference between the default budget and the operating budget and reduced that by the projected return of $610,000 which was already part of the calculation and thus these fallacious numbers presented to the taxpayers in the Goffstown News include an estimated return of $1,220,000. In essence,

the provider of this information has just informed the taxpayers that if they do not vote for article 2, their tax rate will go up only $.14 per thousand when in fact it is estimated to increase by another $.43 or a total of $.57 per thousand. The impact of supplying this false information for a $250,000 assessment is not $35.00 as printed in the paper but three times that for an additional $107.50 to come to an accurate projection of $142.50.

This is not the best we can do and is a disservice to the voters who are looking to their elected officials and the people they hire to provide accurate and unbiased information.

On behalf of the Budget Committee & pursuant to

RSA

32:16,II, I ask:

1. Who is responsible for the calculation you provided?

2. Who approved its release?

Thanks,

Dan |

Allard then forwarded two spreadsheets (, along with the

following response:

-------- Original Message --------

Subject: Re: Budget Comm - Request for Calculation

Date: Fri, 05 Mar 2010 12:20 PM EST

From: Keith Allard <kallard@goffstown.k12.nh.us>

To: <AlphaOmegaNH@comcast.net>

CC: Ray Labore <rlabore@goffstown.k12.nh.us>, Stacy Buckley <sbuckley@goffstown.k12.nh.us>,

(Goffstown School Board), (Goffstown Budget

Committee)

Dan

You are more than welcome to request information but please do not add your editorial thoughts to the request. They are not welcomed. I have enclosed a copy of

RSA 32:16 below so everyone can understand the RSA you are referencing. We did tell them that the state rate was $2.41 based on the projection from the state. If a change in the rate occurred from the state, we have not been notified. If you have a concern with what the Goffstown News printed and their math calculations, please contact them. We do not have any editorial control over the paper and I was not consulted about this article before it was written. We simply provided the numbers on the attached worksheets. I have attached two worksheets,

one which the school board used back in January to compare tax rates resulting from different scenarios and the second, a condensed version of the January sheet addressing just the operating budget and default calculations that are under discussion. It’s title is

“Tax Rate Worksheet

3-2-10”. I would also like to share that Sue D. has been made aware of how we calculated the numbers for the voter’s guide and has not shared any concerns. I believe your assessment of the situation is incorrect.

Keith |

After examining the spreadsheets provided by Allard, Mr.

Cloutier uncovered the "discrepancy":

-------- Original Message --------

Subject: Budget Comm - Request for Calculation

Date: Fri, 5 Mar 2010 1:25 PM EST

From: Daniel J. Cloutier <AlphaOmegaNH@comcast.net>

To: 'Keith Allard' <kallard@goffstown.k12.nh.us>

CC: Ray Labore <rlabore@goffstown.k12.nh.us>, Stacy Buckley <sbuckley@goffstown.k12.nh.us>,

Sue Desruisseaux <sued@GoffstownNH.gov>,

(Goffstown School Board), (Goffstown Budget

Committee)

Keith,

You are correct in that you have no control over what is printed in the Goffstown News and that is why my emails have requested information and not assigned blame.

The state rate is based on the assessed valuation of utilities. In the calculation of a state rate it is inconsequential whether this analysis uses $2.41 or $2.31 as the difference will be adjusted in the local rate to come to the same total rate for the school.

It is in the information that you have provided to us in your previous email which was also provided to the Goffstown News where the $610,000 of unreserved fund balance is

MISSING from the Budget Committee column.

This estimated amount was included in the presentation at the public hearing held on January

6th, it was included in all the spreadsheet calculations that you were provided directly as the alternate member of the Budget Committee and hopefully from Suzanne’s participation on the Budget Committee.

Therein lies the discrepancy and the “editorializing” word inaccurate.

The information is factual that the $610,000 is missing from the column that would have reduced the calculated Budget Committee tax rate on the spreadsheet provided to us today and to the Goffstown News by $.43 and thus have the difference in estimated tax rates the voters have to choose from be accurately reflected.

Current question:

Why is the $610,000 of estimated use of unreserved fund balance missing from the calculation of the Budget Committee tax rate on the spreadsheet provided to us today and the information provided to the Goffstown News?

Dan

P.S. Since you have brought up Sue D in your last email, I have included her in this exchange. |

Allard

then suddenly stopped responding,

Since Allard had been responsive throughout the day, this non-responsiveness

indicates an unwillingness to state what appears to be the facts. Given the scenario of a response that indicated the

Budget Committee''s spreadsheet was originally correct and

the school board's did not include the $610,000 of unreserved fund balance

so as to "reduce" the estimated tax rate, the logical conclusion, absent a response from the chair of the

school board, would be that it is indeed intended to be that

way, and intended to mislead Goffstown's taxpayers..

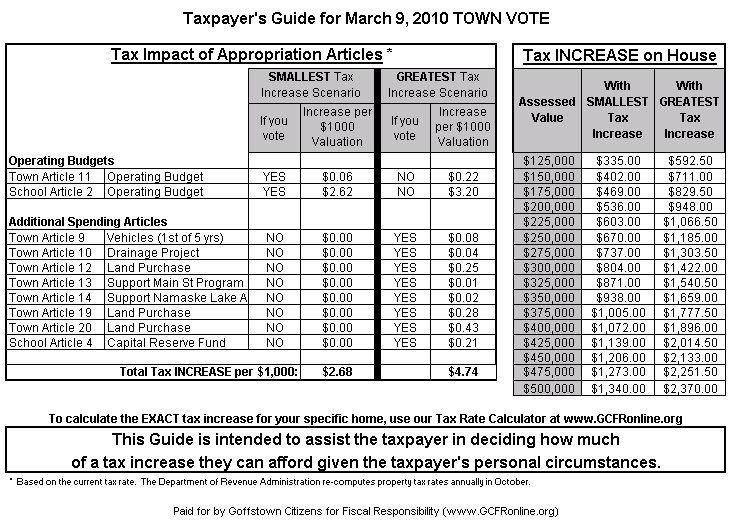

Want

to know how your vote on certain articles will REALLY

affect your personal taxes?

Click on the link below to use our calculator.

2010 Tax Rate Calculator

or

Right-click

here to download to your computer

Copyright©2010,

Goffstown Residents Association. All Rights

Reserved.

|