|

To the Editor:

Many older Goffstown baseball fans will be familiar with legendary Yogi Berra’s famous quip. “Déjà Vu all over again. Yogi had a pocket full of these kinds of quips that amused and befuddled fans.

Déjà vu roughly translates into something like “here we go again,” “same stuff – different day” or perhaps “been there – done that.” And that is exactly what is happening today…again!

Many older Goffstown residents will also remember the Savings and Loan (S & L) crisis of the early 1980’s. This crisis affected many local residents as well as the entire nation.

New condominiums were being built in Goffstown and were being sold for around $150,000. Then all of a sudden the housing market “crashed,” condominium prices plummeted to $50 - $60 thousand (no takers), residents who bought at the top of the market were “underwater” (and about to lose their property.) Amoskeag and Indian Head Banks went bankrupt and were acquired. Sound at all familiar?

In the 1980s, over 800 S & L banks went bankrupt nationally and they had to be bailed out at great taxpayers expense. Beginning to sound even more familiar? This FDIC website documents the data:

http://www.fdic.gov/bank/historical/s&l/

In September 2010, there are over 125-bank failures year to date with over 800 more on the list of “troubled banks.” What more needs to be said about the bank bailouts. And yet if people have been paying attention, 5 big bank profits and bonuses have gone “through the roof.” Ever wonder why?

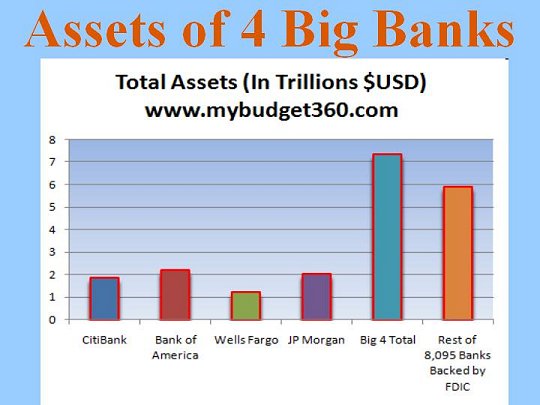

The embedded graphic shows the total assets of the four “big” banks that got bailed out.

This list doesn’t even include Goldman Sachs, which was allowed to convert to a commercial bank so that it could be “bailed out.” Socialize risk. Privatize profit. What a model for free-market capitalism (Not!) The total assets of these 4-5 banks exceed the total assets of 8,095 banks backed by the FDIC!

These banks also control 98.8% of the hundreds of $ trillions of debt derivatives??? What happened?

Why is this an issue for a Goffstown resident? Answer: Because our children and grandchildren get to pay off this staggering debt! Have you seen this yet?

http://www.usdebtclock.org/ Now what?

This unpayable debt will also drive up our property taxes because of the destruction of the US $!

There are at least 3 possible ways to directly fix this in NH.

· Create a NH State Central bank similar to N. Dakota (mostly escaped financial crisis.)

· Return to constitutional money (US Constitution, Article 1, Section 8, para. 5 & Section 10.)

· Develop a local barter currency in an emergency.

http://www.transaction.net/money/lets/

Goffstown residents don’t have to be at the effect of this colossal financial heist of the middle class.

To be at the effect of this financial heist, means that Goffstown residents will continue to see their property taxes double every 10 years or less. Why permit a hand full of banks to do this??

Failure to be aware of what is happening and to protect our families will have some consequences!

I just thought that you had a “Right to Know” (R2K.)

Ivan

Beliveau

Goffstown

|