|

To the Editor:

Many older Goffstown residents who enjoy ocean cruises will remember the cruise ships Queen Elizabeth and the subsequent Queen Elizabeth-2 (QE2.) These proud ships were in service for a very long time. The QE2 sailed with an unblemished record for 40 years until 2008. There is another QE2, however, that is leaving port that may set a record more like the Titanic

QE2 is also an acronym for “quantitative easing” which in Fed Chairman Bernankespeak really means inflation. Quantitative refers to quantity; easing means increasing the supply of money. Got it?

The first round of quantitative easing didn’t work, so the thought goes, let’s do it again. Splendid!

Goffstown residents may need to be prepared for the consequences of another round of increasing the supply of photocopier money. That consequence includes the doubling of property taxes…soon!

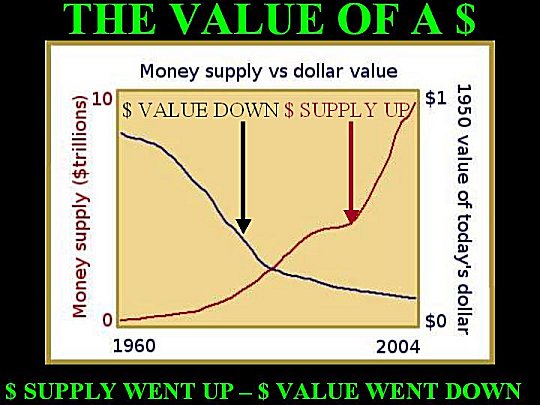

The graphic below shows the relationship between the supply of money and the value of money. The graph really just shows the first lesson in Economics 101: Supply and demand determines the value of things – money included. Everything else being equal, it is that simple! Wait, there’s more.

The real hooker is that as the value (purchasing power) of a $ goes down, it takes more of them to buy something. Think about that for a moment. If it takes more dollars to buy something, then isn’t that the same thing as a price increase? From a “big picture perspective,” what does that really mean?

Does that mean that from 1960 to the present, a lot of the price increases in things is due to a loss of value of the US dollar? The qualifier “everything else being equal” also means something.

Demand can also drive price increases as well as quality improvements. Improve your house in a very desirable, growing residential area and the house value should go up…unless the value of a $ goes up.

That is the paradox: If the value of a dollar goes up, it takes less of them to buy something, which is the same thing as a price decrease. It is almost perverse and counterintuitive, isn’t it? But true!!

Who would ever want the price of things to go up? Easy. Stockowners, asset owners, speculators, bankers, and brokers want prices to go up so that they can sell those things at a profit.

Who would ever want to see stable prices and wages? Easy. Businessmen trying to maintain a business want to see stable prices and wages so they can run a profitable business, sell products and employ people. Have you noticed what life is like when there are few good manufacturing jobs?

Who would ever want to see the price of things go down? Easy. New homebuyers, people on limited/fixed budgets and those wanting to buy things at reasonable prices want prices to go down.

Ironically, governments want to see the value of a dollar go down so that prices go up. The reason for that is that inflation (the loss of value of a $) is an invisible tax. This isn’t easily understood by most.

Governments hate to cut spending or tax people directly. That isn’t good for their job security.

Using money as debt makes the process of taxing people invisibly much easier. Creating more deficits (debt) gives the government money in the short term, raises prices longer term and makes almost everyone happy…until it doesn’t. It is a way of passing costs into the future that is confusing.

Relying on future earnings to pay current costs has a definition that is the subject of a future editorial.

Ivan

Beliveau

Goffstown

|