|

To the Editor:

In round figures, there are around 17,000 residents in about 7,000 households in Goffstown. Presumably most residents enjoy the somewhat quiet country atmosphere around town and the activities typical for a NH suburb. Many residents are themselves homeowners.

Many, perhaps most, Goffstown homeowners undoubtedly also own nice newer cars, big-screen HD TVs and all the other “stuff” that is perceived to be necessary to have for living the “good life.” A reasonable debate isn’t about whether it is a good thing to own things; it is about the observation that people really ought to consider whether they really own the things at all and what that could mean.

Most people are aware that if too many car payments are missed, then a person driving a tow truck with a big “hook” could come by to “repossess” the nice newer car. The point to be made is that people don’t really own anything until it is paid-off and the title is in hand. Until the time that the “title is in hand,” the creditor “owns” the car. That principle also applies to homes.

Most people understand that there are also other ways to have a home repossessed. For instance, the town could take the home for failure to pay property taxes.

Read the back of the “Goffstown Property Tax Bill” for details:

- Liens are placed on properties for the amount of unpaid taxes, accrued interest and costs. Interest accrues on the lien balances at 18% (APR.) Liens are generally placed within 120 days after the December due date.

- Taxpayers have two years to redeem liens, interest and costs prior to the Tax Collector deeding the property to the town.

The back of the tax bill also explains “Property Tax Relief Programs.” Some people might find it a good idea to look at and consider filing a “Property Tax Abatement Request.”

The Goffstown Tax Collector probably hasn’t been very busy “repossessing” property tax delinquent homes. The future, especially if the economic downturn continues, could change that quite a lot. The point to be made is that the Tax Collector has the legal authority to deed a home to the town.

Banks and credit bureaus might also be somewhat less forgiving with delinquent mortgage payments.

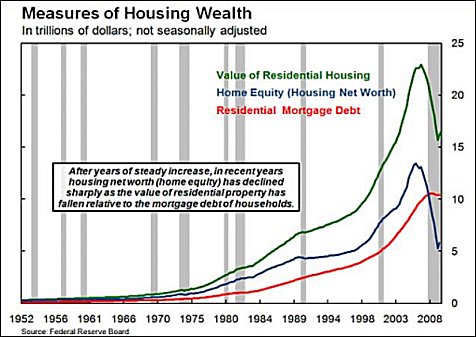

The embedded graphic shows the declining housing prices, homeowner equity and rising residential mortgage debt on a national level. Goffstown data might also show the exact same trends.

The red line on the graph shows the increase in mortgage debt mostly due to refinancing.

The green and blue lines show the sharp decline in house prices and homeowner equity in the last 5 years. In fact, it can be seen that the bank “ownership” of homes and land is higher than what people own (the blue line has dropped below the red line.) The data could and should be challenged, but is it incorrect? It could be concluded that around $7 trillion of homeowner equity/value has been lost.

The numbers on the right hand side of the chart are in $trillions. Look at the losses in “value!”

Well the distressing news might be that homeowners who are “underwater” in their mortgage and property taxes can choose to lose the house to the bank or the Goffstown Tax Collector…some choice! Does it seem right that Goffstown might take a home from people in financial trouble?

I just thought that you had a “Right to Know (R2K).

Ivan Beliveau

Goffstown

|